October 28th, 2023: Greetings from Taipei. As you might have noticed, I updated the newsletter from “Boundless” to “Pathless” and brought it under the subdomain pathlesspath.com. Over the past couple of weeks, I’ve been moving over the podcast, resources on self-publishing, my community, and some other resources under this brand. While I was hesitant for a few months, as soon as I made the shift it felt right and obvious and sometimes these kinds of changes can be a good way to recharge and carry on. “Boundless” was a name that resonated with where I was in 2017 - a bit lost, optimistic, and wanting to explore many things. It felt empty but in a way that was empowering. “Pathless” feels more focused, or at least aligned with the spirit of what I was trying to put out in my book, something that seems to have caught on far beyond my imagination. I plan on sharing more over the coming weeks but you can check out the updated information on The Pathless Path community, something I’ve been trying to reorient much more around my own content creation and ability to connect people, rather than something where I’m hosting a lot of live events myself.

On to this week’s guest essay by Alex who is sharing his own winding journey of betting on himself, facing some challenges, and asking for help.

Fixing in Public (by )

There are a lot of folks who ‘build in public’, meaning they chronicle their journey as they start a business or launch a new project or venture. I’m at a different juncture—my business is on the brink of failure. I thought this might be an appropriate time to try ‘fixing in public’: sharing what’s going on, why I ended up here, how I’m thinking about all of it, and how you can get involved if you’re so inclined.

________________________________________________________________________

My phone vibrates. I recognize the number and answer on the first ring.

“Mr. Michael?” the voice asks. Matt is his name. I’ve talked to him a few times over the past week. The forced professionalism and script-reading tells me he’s a kid, probably twenty-three or twenty-four, working his first post-graduate job.

“Hey Matt. What’s going on?”

“Hi, I’m doing well, thank you. I wanted to let you know we’re unable to move forward with your loan application.”

“Oh. Well, damn. Why’s that?”

“Unfortunately I’m unable to share that information with you at this time. You will receive a letter in the mail within thirty days containing the reasons for the decision.”

I sink into the crater on my couch. “So…you can’t just, like, tell me now?

“No sir, I’m sorry. We’re not provided with that information.”

Awesome.

Matt is the third banker I’ve talked to this week and the fifteenth this month. Though I’ve come to expect the rejections, they still sting. Each one represents the loss of one more potential lifeline. Right now my business has about enough runway to make it to February. Beyond that, the best-case scenario is a forced sale. The worst is bankruptcy.

Acquiring The Business

When I signed the Infinite Jest-sized stack of paperwork in February of 2022, I became the proud owner of both a thriving online wallet business and about $700,000 of personally guaranteed debt. The latter didn’t scare me. The business was making enough money to cover the debt payments, and I figured I’d double its profitability in the next couple of years. I’m smart. This was an Amazon business, not a craniectomy. I’d figure out how to grow it quickly and then sell it a few years later for a life-changing sum.

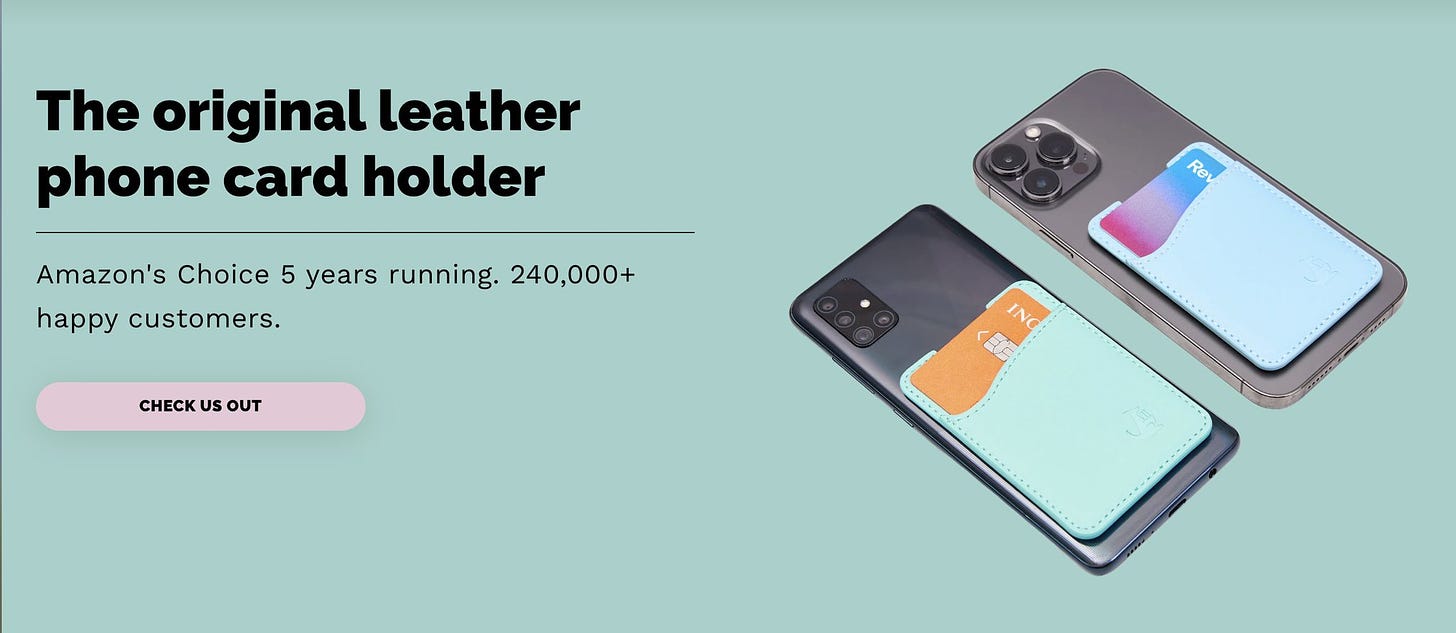

I sat on my not-yet-cratered couch and devised a plan. At the time, the business had one product, a leather wallet that sticks to the back of your phone. The photography and branding on the product page left a lot to be desired. Still, it managed to bring in over half a million dollars in revenue each year. All I had to do was pour fuel on the fire. If I doubled down on advertising spending, gave the images and branding a makeover, and launched a portfolio of adjacent products, the kind of growth I was after would be an inevitability.

All of this required capital. Luckily, banks are eager to lend you money when you have a growing business. I clicked the little yellow button to make my electronic signature appear at the bottom of the DocuSign loan paperwork and tens of thousands of dollars of working capital was transferred to my account. I began spending on my future.

It started off well. Revenue in my first year of ownership shot up to almost a million dollars. My investments were working; the rebranding had already generated a significant return, and the new product launches were showing strong positive signals. As long as I kept selling wallets, banks were happy to keep lending.

What I didn’t account for was the possibility of those wallets vanishing.

On a seemingly unremarkable Tuesday in June of this year, I opened my Amazon Seller Central account to learn that Amazon had lost about three months’ worth of inventory of my best-selling products. The shipment had just disappeared on its way to their warehouse. Gone. No explanation.

This led to a long saga that ended with Amazon reimbursing me about half of the market value of what was lost. This in and of itself would have been painful but manageable. But it was the domino effect that ensued as a result—having to order more inventory well ahead of schedule, the opportunity cost of lost sales, and Amazon’s algorithmic punishment for going out of stock—that turned this into a full-blown crisis. It’s hard to put a number on how much it ended up costing altogether. But if I add everything up, factor in additional debt, and carry the seven, it was—checks notes, glances at calculator, laughs wryly—really fucking expensive.

In aggressively spending towards rapid growth and a quick sale, I left myself exposed. I had no war chest to protect against the effects of plummeting sales. The equation was eventually flipped on its head: the money coming in was no longer enough to meet the debt payments.

Now I spend much of my time talking with bankers like Matt. They tell me that even though my business is recovering and its future is bright, they can’t refinance my debt to reduce the payments because I haven’t owned the business for long enough, or because I don’t have any collateral. If I can’t refinance my debt I’ll be forced to sell the business. And the debt has snowballed to the point that, even after selling, I might still owe money. That’s when the b-word comes into play.

Less than six months ago I fancied myself a great entrepreneur. I expected to be selling the business in a few years for a number with seven digits in front of the decimal. Now, I’d be happy to get out with nothing.

“Failing” On My Own Terms

It’s tempting to say that I feel like a failure. I suppose that’s partially true. I’m embarrassed, humbled, and a bit regretful. I’ve spent plenty of sleepless nights submerged in self-doubt, showering myself with blame. But saying I feel like a failure would be too tidy, too simplistic. Because while I sure as hell made some mistakes, I’ve also realized that I made some pretty good decisions, too. I had a once-in-a-lifetime opportunity and I went after it. Hard. And I’d do it again. Had my inventory made it to its destination, I might not be writing this essay.

But it didn’t, and I am.

What I feel more than anything is fear. My fight-or-flight response wakes up when I do, sometimes earlier, and hangs around until I go to sleep. My stomach turns every time I open my bank account to see a shrinking number or an email kindly notifying me about another debt payment that’s due. I’m reminded of the gravity of my circumstances, of the clock that continues to tick. I’m forced to confront the possibility that, at age thirty-one, after almost a decade of having financial security and feeling like I was building a monetary foundation to support the milestones of growing up—buying a house, getting married, having kids—I may have to start all over.

And yet, somehow, on balance, I’m as happy as I’ve ever been.

It’s funny: five years ago, I had an interesting-sounding job that paid very well, a brand new charcoal gray Jeep Grand Cherokee Trailhawk, and an abundance of predictability. There was nothing that resembled any kind of tangible crisis, no looming personal apocalypse. Money certainly wasn’t an issue.

I also had no control over my existence. No influence over the direction of my life. No ability to actualize what I really wanted. I spent much of that period thinking about how to kill myself.

Today, all I have is fear, uncertainty, and the threat of insolvency. This has objectively been one of the most challenging experiences of my life. But in many ways my existence has felt easier, or at least more optimistic, than five years ago. How could that be?

The answer is that I’m living a life that is mine.

My operating philosophy over the past few years has been that agency and self-sovereignty are the most important qualities we can cultivate in ourselves. My belief has been that when we develop a deep, genuine understanding of who we are and what we want and then learn to give ourselves permission to pursue that path, we show up as the best version of ourselves in the world and can fully engage with it. This imbues our relationships, our work, and our existence with a fundamental depth and meaning because we are acting from a place of authenticity.

But it’s easy to justify a belief system when things are going well. I wrote a lot about the transformative power of these ideas when the business was growing and life was relatively easy. Now that I’m confronted with a crisis, it’s a perfect time to ask: does my belief system hold up?

Well, I’m staring down the barrel of bankruptcy with no idea what comes next, and I have a better quality of life than I did when my bank account and 401(k) had big numbers with lots of zeros after them. So I’d say that’s a yes.

Living on my own terms has fundamentally transformed the texture of my existence. The fact that these are problems I’ve chosen, that they are part of what comes with the path I’ve consciously created, makes them worth the cost a hundred times over. It gives them an entirely different flavor. Instead of being forced to deal with the challenges of circumstances that were decided for me, I’m grappling with adversity in an arena I’ve built. That’s the kind of life worth living: one in which I control the terms of my engagement with the world, regardless of what happens.

Whatever the outcome, I know on a deep level that I will be okay. I’ve learned who I am and how to give myself permission to pursue my own path. If I continue to operate from this place, it’s impossible to lose. I’d say that’s a hell of a North Star.

Time To Ask For Help

This experience has also provided an obvious but forgotten addendum to my beliefs: that a central feature of agency is a willingness to ask for help.

I’ve had a lot of candid conversations with my family and girlfriend over the past month, reluctantly sharing the reality of the situation in raw detail. This makes me nauseous. My ego doesn’t like to ask for help. It feels like failure.

But with a comical predictability, these conversations always help. At the very least, I feel profound love and unconditional support. And I often end up with an idea I would never have considered.

One of these ideas was to be transparent with my readers and tap into the wisdom of the crowd, leaning on others at scale. The idea of this magnitude of vulnerability initially made me recoil. It’s hard enough to bring in those close to me, let alone the infinite abyss of the internet.

But part of having genuine agency is, paradoxically, knowing that you aren’t alone. Agency is not individualism. The purpose of having self-sovereignty, of knowing yourself and living a life that is your own, is that it enables you to fully engage with the world, and to show up as the best version of yourself. You can’t build full, authentic relationships with others before doing so with yourself. But the latter is a means, not an end. The ultimate aim of all this is to experience the journey of life with other people, not apart from them.

With this comes the humility to ask for help. So here I am, doing so sheepishly.

Many of you are much smarter than I am, and much more experienced. I’m curious to hear what you would do in my situation. I’ve created a data sheet with more detail and numbers that I can share. I would be tremendously grateful for any and all advice. If you’re willing to have a live conversation, that would be amazing. If not, even a directional comment or a brainstorm is a huge help. And if you’re not experienced with this kind of thing but still want to help, here’s the link to buy a wallet.

Having had a number of conversations recently that opened me up to new possibilities, I’ve been reminded that all streams of consciousness are helpful. Anything can spur an idea, or a connection, or some other kind of serendipity that can only be solicited by sharing all of this. I’ve come to believe in the power of putting the truth out into the ether. Even if doing so doesn’t result in a solution, it is aligned with my values and the way I want to live. That is more powerful and life-giving than any amount of money.

I might lose the business. I might lose another business in the future. It’s in my nature to go after what I want, to move quickly, to take risks. These kinds of situations come with the territory. But facing this difficulty has solidified, more so than any amount of success ever could, what matters to me and what can’t be taken away: spending my short time on this spinning rock living a life that is truly my own, so that I can fully experience it with the ones who matter most.

Thanks For Reading!

I am focused on building a life around exploring ideas, connecting and helping people, and writing.

If you’d like to meet others doing the same, you can join The Pathless Path Community if you want to hang with us too, or if you are already a subscriber, get access here.

If you’d like to support my journey, the best ways are to:

Buy or listen to my book, The Pathless Path (or message me if you want to bulk order at a lower price)

Want to reach 15k+ curious humans? I’m looking for sponsors for 2023 for this newsletter or podcast. Please reach out or book a package here directly.

Subscribe to my podcast and leave a review.

🤳Want To Get Started on Youtube? Friend of the newsletter Ali Abdaal (and his amazing team) have just launched their self-paced course and accelerator program on creating a thriving YouTube channel.

In addition, I recommend all of the following services (affiliate links): Collective for setting up an S-Corp in the US (recommended >$60k revenue), Riverside.fm for HD podcasting, Descript for text-based video editing, Transistor for podcast hosting, Podia or Teachable for courses, Skystra for WordPress Hosting, and Circle for running a community.

A reminder: I don’t check unsubscribe alerts and never look at my subscriber list. So if you feel like unsubscribing, you can do so below.

Probably my favorite post of the year! Wishing you the most successful turnaround of Wallaroo!

Love this!

"Now that I’m confronted with a crisis, it’s a perfect time to ask: does my belief system hold up?"

This is big...how do we hold up when under pressure? Thanks for being vulnerable and sharing your story!