September 17th, 2022: Greetings from Lisbon! It was a bit rainy this week so I only did a bit of wandering but did quite a bit of reading. We are headed to Porto for the next couple of days.

+Had an epic convo with Gary Ware on injecting play into work & life. We also dug into his journey and how growing up with the script, “you can play when the work is done” led to some unintended consequences. It’s also on Youtube here in HD.

+ My friend Diania Merriam who runs the EconoMe conference wants to give about 600 of my book away to attendees. She’s looking for someone who’d want to help sponsor this. If you are interested, let me know!

#1 More Streams, More Dreams

In the past year, I’ve had a few unexpected income streams emerge. First was my book. I didn’t have any expectations about my book in terms of money but it’s done well and is on track to generate about $20k in profit this year. The book’s success also drove attention here and to my podcast, which has inspired sponsors to support my work. In addition, corporations are finally open to virtual learning approaches and I’ve run a number of paid workshops for companies. It’s probably the first year that I feel like I can take a step back, think a little further out, and dream a little about the possibilities of this path and that has been pretty cool.

Having “income streams” is a weird thing compared to paycheck life. In a full-time job, you know the exact number of dollars you are promised every year. You also know how much you make after taxes and when that money will hit your bank account. Every time this money hits your bank account it’s also an affirmation of deep-rooted faith in the idea that full-time employment is stable and smart.

Making money while self-employed is totally different. I have no idea how much I make in a year until I file my taxes. I only get a sense of how much money I’ve made in the short term when I download the data and do some spreadsheeting. Sometimes it’s more than I expect and sometimes it’s less than I expect. But this is only gross income. I pay various fees and expenses to make a bunch of things happen and I only have a rough idea of the margin I make on things. I automate most of my spending and investments and then just watch my business checking account total. If it goes up, things are great. If it’s going down, uh oh!

You might be wondering, shouldn’t you be better at this? Didn’t you get a fancy MBA? You are right and if I wanted, I could run a really tight ship, developing impressive dashboards and fancy ratios that get updated weekly. However, in addition to being CFO, I’m also head of creative, marketing, technical operations, design, and sales. My goal is to remain on this journey as long as possible and any energy I spend in the CFO role sucks energy away from other things that I like doing more, not to mention might have better odds of keeping those income streams flowing.

Streams On Streams

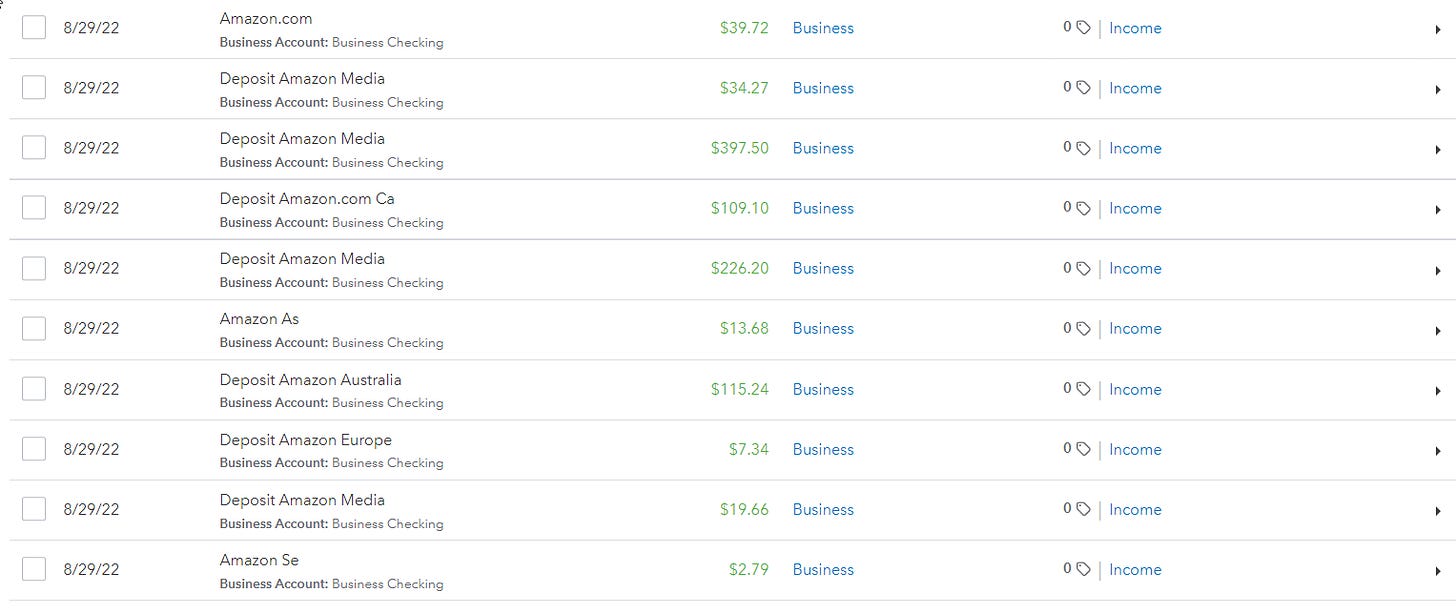

A couple of years ago it seems like the number of income streams I had coming in was exploding. This is partly a result of having more “bets” out there, and also companies getting more sophisticated at payments, and tracking income across geographic regions. For an example of what it looks like in my bank account, here are the payments for book sales from Amazon for June. Ten micro-payments!

$2.79 from Sweden? Pretty wild. As you can tell it’s pretty hard to figure out the total of all these payments and in my current state the only way I really know how much I make is to get to work in Excel.

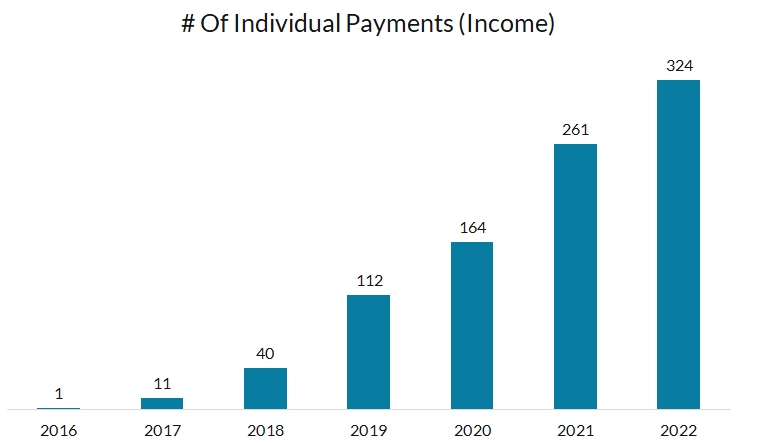

When I took a quick look at how many individual payments I’ve gotten by year, I was a bit shocked.

2022 is over 300 and it has four more months to go!

The experience of this is confusing because this chart doesn’t track my income. It’s definitely going to be a lot higher in 2022 but it didn’t actually increase in 2018 or 2019. It went down a bit from 2017. It was just that I shifted from only freelancing to working more in the creator economy.

This newsletter is an example of one of those things. About 65 of you generously support me via a monthly or annual donation to my efforts. Annually this is about $3,500 a year give or take. But Substack doesn’t pay me! You all pay me directly, via stripe. If everyone paid monthly, I’d receive about 780 deposits in my bank account per year. I tried describing all this to a friend recently and I realized I didn’t really have the words to convey it. I showed him my bank account and all the micro-deposits and he acknowledged, yes that is a bit weird.

Time Is Money

In paycheck world, people give up five days every week for a fixed price and because of this, they tend to know the “price” of their time. Time is money.

In my world, time is only sometimes money. If I spent all my time trying to make money I would make less over the long term because I’d burn out. And unless I’m doing freelance work, I don’t know how much I’ll make and for how long, not to mention knowing when the money will arrive.

In a weird way, the mindset of “time is money” only makes sense if you’ve already given away a lot of your time for money.

In my world, things are a bit more nebulous. Some of my time and effort may turn into money but some of it may not. This makes me want to be strategic about making money but it also lets me see that there’s value in doing things for the sake of themselves in that they might just make my life better.

Somehow over the past couple of years, I’ve reached a semblance of income stability. For at least 24 months, I’ve had an income floor of at least $3,000 in income (actual profit may be lower!). This feels like having a $36k basic income except the confidence it buys me is worth way more than the equivalent full-time salary not to mention one making 3-4x more. I like doing most of the things that led to that income and I’m happy to keep doing them. No boss, no complaints.

Having a decent floor has been great for giving me confidence and thinking further into the future but it doesn’t erase the reality that my future income flows, while at little risk of going to zero, are still relatively unpredictable. I need only a fraction of my former income for a decent stretch to feel completely secure on my path but would need much more to be making equivalent financial commitments like buying a house. This is fine because at this point in my life I prefer being a part-time index fund manager to a part-time home caretaker.

Chaotic Uncertainty & Income Modes

This chaotic uncertainty drives a lot of self-employed people to work non-stop and seek out tangible financial goals in order to fill the void of not knowing. But this can only last so long. Most people that stay on a solo path like mine either decide to scale into something bigger or commit to a set of activities that will set them up to meet their needs with a high probability of success.

Right now, I don’t know how much I’ll make next month let alone next year. But I feel good about what I’m up to and sense I can keep going for a long time.

One of the cool things about all those different income streams is that I didn’t need to be one kind of person to make them happen. The deep commitment of writing a book over a year led to some income. The weekly rhythm of writing this newsletter leads to some too. Deep conversations on my podcast lead to all sorts of opportunites. Writing online to others. Running workshops enables me to make money in an analytical mode that can be fun for short bursts but not year-round.

Multiple income streams are great for diversifcation of income but even better for diversification of your actions. One of the biggest downsides of full-time employment is that in today’s world, if you are successful, you will find yourself on a path doing a very narrow set of things surrounded by a very narrow range of personalities. This kind of environment stifles my imagination and convinced me that I was selling my time too damn cheap.

So I present the most obvious conclusion: more streams, more dreams.

ICYMI - last week, my thoughts on effective altruism and the success trap

Thanks For Reading!

I am focused on building a life around exploring ideas, connecting and helping people, and writing. If you’d like to support my journey, the best ways are to:

Buy or listen to my book, The Pathless Path

Purchase one of my courses on freelancing or reinventing your path

Subscribe to my podcast and leave a review

Support this newsletter through an ongoing micro-donation with 68 others

In addition, I recommend all of the following services (affiliate links).

Riverside.fm: HD Video and Audio Podcast recording

Transistor - 14-day free-trial podcast hosting

Podia - 14-day free trial (read my review here)

Teachable - 14-day free trial

Skystra - Fast WordPress Hosting

Circle - 14-day free trial

A reminder: I don’t check unsubscribe alerts and never look at my subscriber list. So if you feel like unsubscribing, you can do so below.

I've been self-employed all my working life. I was doing "multiple income streams" before people had a name for it. That's because I wanted to be independent and just couldn't put all my eggs in one basket. Besides, I always have multiple interests. Years ago, I figured that the best way to live my life was to find a way to monetize all the things I'd be doing anyway. And this philosophy stuck. I've done well for myself. But one thing that absolutely needs to be mentioned - not only generating income but how to steward that income is just as important. I've done even better, considering that I've invested wisely, and at this point, the money I've invested makes more money for me annually than I generate from my multiple income streams. It takes financial uncertainty out of the equation.

Great piece. It's always interesting to see how everyone figures things out for themselves. Good luck.

Yea! I should write about how I invest at some point.